Image via WikipediaWhat did the housing bubble do to the money supply? Well, we don't know: the Federal Reserve decided to stop calculating the broadest measure of the money supply known as M3. Just too darn expensive they said. Or it was hurting their efforts to get the ostrich head deeply into the sand.

Image via WikipediaWhat did the housing bubble do to the money supply? Well, we don't know: the Federal Reserve decided to stop calculating the broadest measure of the money supply known as M3. Just too darn expensive they said. Or it was hurting their efforts to get the ostrich head deeply into the sand.In any case, the perceived wealth of homeowners that enjoyed swelled home values, as well as the actual supply of dollars soared during the boom. All assets, real and paper can be traded interchangeably, so together there is a total amount of value or wealth in the system.

Now, what happens when the value of assets suddenly erodes, as they have with the mortgage crisis? The total amount of wealth declines. This manifests itself as deflation.

The Federal Reserve hasn't actually removed dollars from the world. But the effect is the same. It doesn't matter whether the breeze you're feeling is caused by a fan or vacuum cleaner.

It is only when money or assets participate in the economy, where one is traded for another, that impacts things. If you build a house and hang on to it for hundred years or bury all your money in the back yard for decades, neither is creating demand or supply for assets. Likewise, when everyone rushes into the market at once, perceived value plummets.

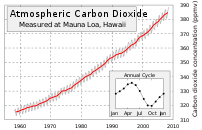

The most stabilizing thing the Fed can do is to support the dollar, that is, keep its value stable with respect to stable commodities. The great increase in the money supply (see the graph) made the housing bubble possible (its not the only cause, of course), but that inflation is in the system and will run its course. The Fed must act in this moment not with respect to things as they used to be.

Unfortunately, the Fed just stares at the CPI when deciding whether there is inflation. As if a statistic created by the government is providing an accurate picture. As if assets don't matter.

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=6150479f-81ed-4892-bf83-b1335a687410)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=b4938220-c253-4cdc-b393-8c0ad9d53355)